2015 Capacity Mechanism Results Analysis

The 2015 T-4 auction cleared 10th December 2015 at £18.00/kW/year (down 7.3% in absolute terms from the price of £19.42/ kW/year in the previous year). A total 46,354MW of contracts awarded in the auction to existing and new build power stations. The 2014 auction was based upon 2012 prices, while the 2015 auction was based upon 2014/15 prices and adjusting last year’s price to 2014/15 prices gives £20.19/kW/year, translating into a real price drop of 10.8% (adjusting for CPI indexation).

Of these awards:

• 91% were existing plant;

• 4% existing interconnectors;

• 4% new builds (including Carrington); and

• 1% was unproven Demand Side Response.

Results versus Expectations

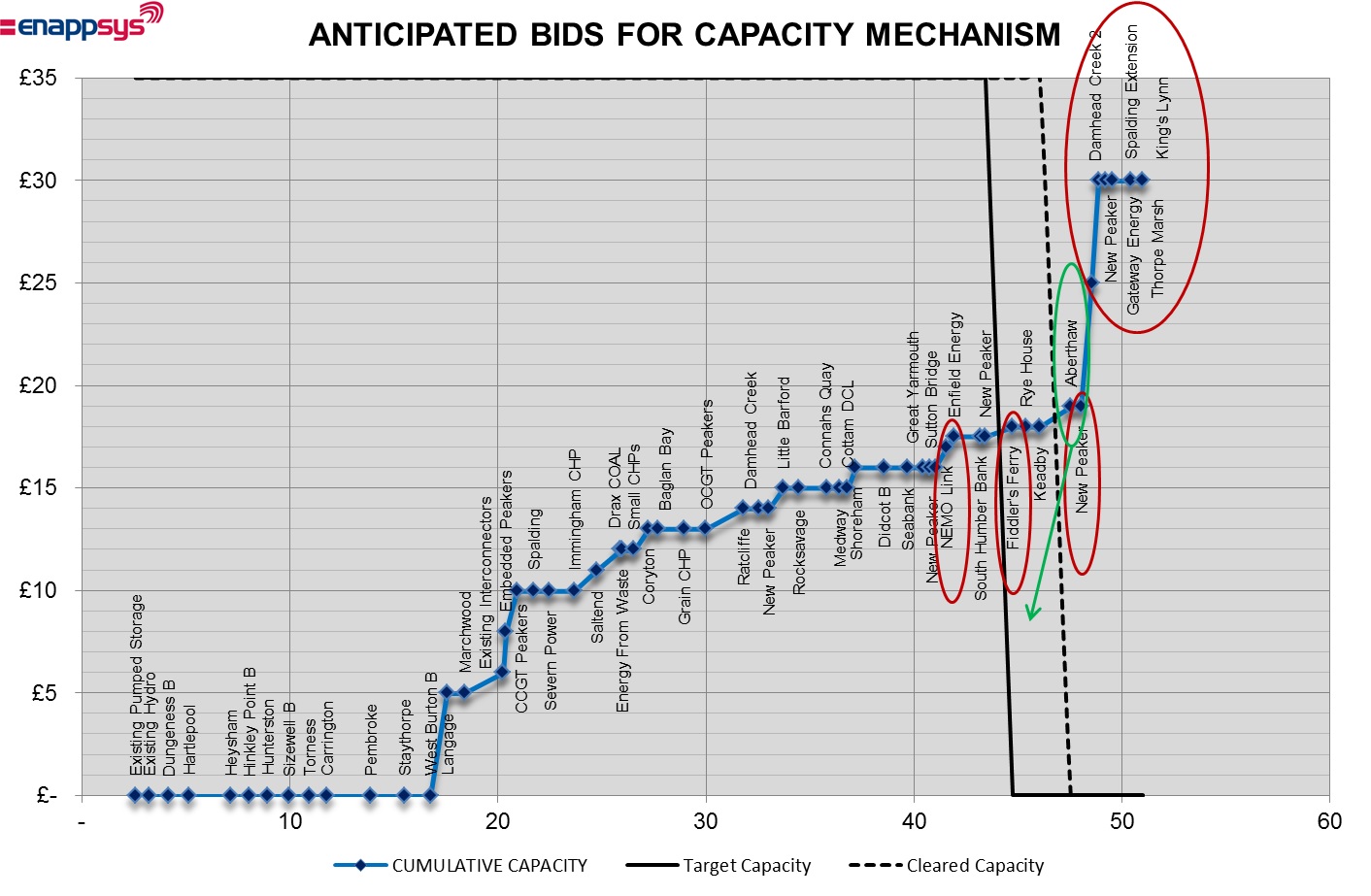

The following chart documents EnAppSys’ predictions of anticipated bid prices into the market prior to the running of the auction. Those that dropped out are highlighted circled in red and those that moved down the expected order circled in green.

The four existing plants that were expected to be on the edge of the market were:

1. Aberthaw (RWE)

2. Fiddler’s Ferry (SSE)

3. Keadby (SSE); and

4. Rye House (Scottish Power)

with Fiddler’s Ferry being the plant that eventually dropped out of the auction.

For SSE, this makes the closure of Fiddler’s Ferry likely, which would follow the expected closure of Ferrybridge (which dropped out of last year’s auction). This would see the last coal plants drop out of the SSE portfolio, which historically have carried a large share of total UK electricity generation.

This will leave SSE with a generation portfolio based upon hydro plants, wind farms and CCGT plants at Keadby, Marchwood, Medway and Seabank. It is expected that Peterhead, an additional SSE CCGT station, will drop out of the market.

The NEMO link interconnector also dropped out of the auction, with this interconnector among those to potentially drop out of the market due to an unwillingness to commit to a go-live date.

Successful New Builds

Aside from Carrington, which was already expected to enter commercial operation in 2016, there were no new build CCGT plants successful in the auction. The growth of renewables and interconnectors has eroded the baseload market making it difficult to finance new CCGT plants.

The remaining new builds were mostly small embedded generators that can take advantage of the rewards offered to plants that offset demand within local distribution networks and reduce the electricity flows across the national transmission network.

Back in 2002, combined electricity imports and renewable monthly generation amounted to 4-9% of total generation within the GB market. While across 2015 to date, the same monthly generation levels have amounted to 23-31% of total generation. This has reduced the requirement for combined levels of generation from conventional sources such as coal and gas plants.

For more information, help or advice please contact Andrew Davison on 0191 211 7950 or email [email protected].